Roth IRA conversions can be a powerful tool for tax planning and retirement savings. However, figuring out the best time of year for a Roth IRA Conversion is crucial for maximizing their benefits. In this post, we will explore the optimal strategies for executing Roth IRA conversions, the associated tax implications, and practical tips to help you navigate this important financial decision.

Understanding Roth IRA Conversions

A Roth IRA conversion involves transferring funds from a traditional IRA or 401(k) into a Roth IRA. This process triggers a taxable event, meaning you’ll owe taxes on the amount converted. However, the benefit lies in the potential for tax-free growth in the Roth IRA, which can lead to significant savings over time.

The Best Time of Year for a Roth IRA Conversion

Many people wonder when is the best time to perform a Roth IRA conversion. The truth is, the timing can vary based on individual financial situations and market conditions. Here are two main strategies to consider:

Plan A: Take a Stand

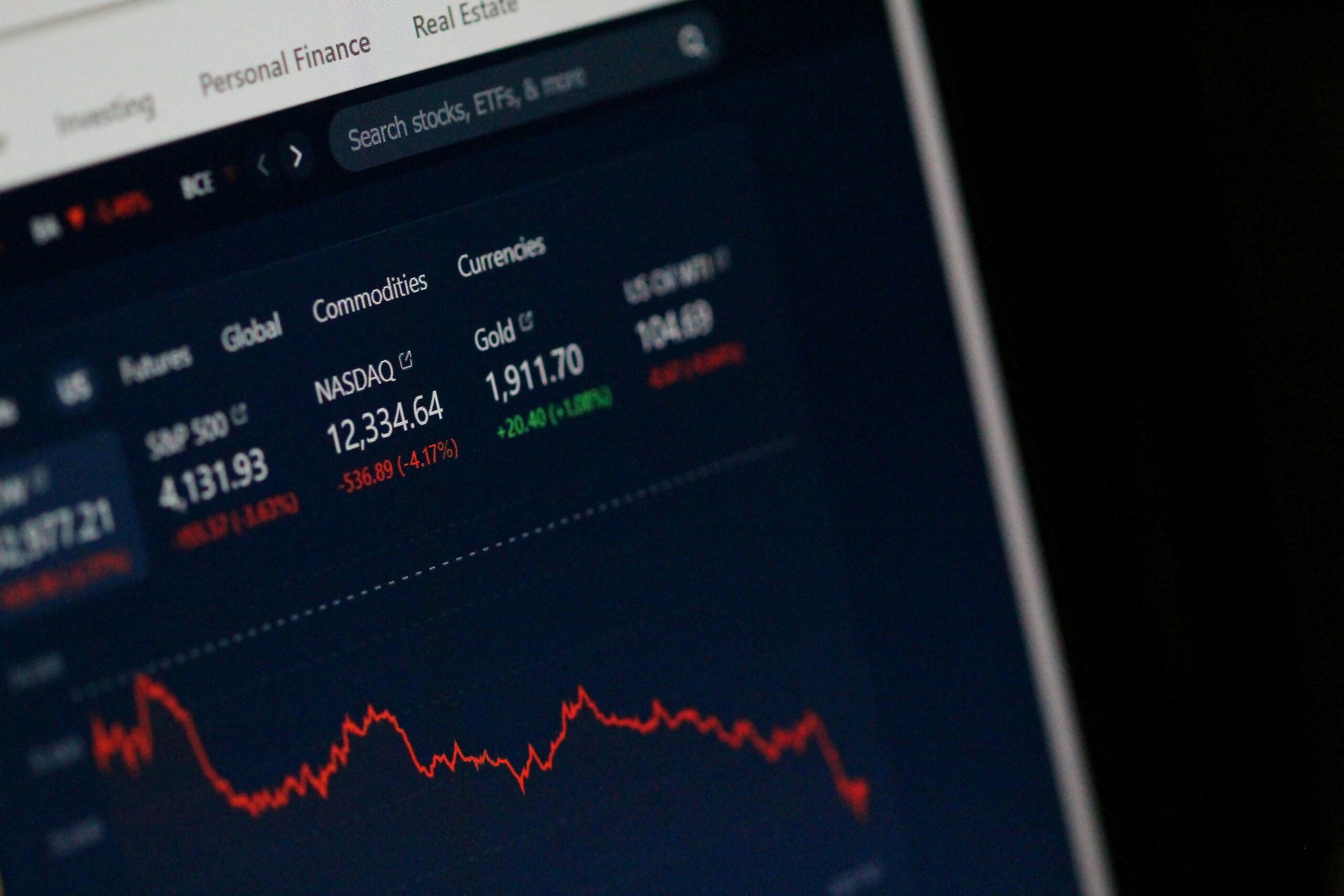

This strategy requires you to make a decision about the market’s direction. If you believe the market is going to rise, it may be beneficial to convert now to allow for growth in the Roth account. Conversely, if you think the market will decline, waiting to convert can allow you to pay taxes on a lower value.

Photo by Anne Nygård on Unsplash

Plan B: Hedge Your Bets

If you’re uncertain about market trends, a systematic approach may be more suitable. This involves scheduling regular conversions throughout the year, such as quarterly or monthly. This strategy helps mitigate the risks associated with market volatility.

Calculating Taxes on Conversions

The downside of Roth conversions is the immediate tax liability. When you convert, you’re creating a taxable event, which can impact your overall tax bill for the year. It’s essential to plan for this tax payment:

- Pay Taxes Immediately: It’s generally recommended to pay taxes at the time of conversion to avoid penalties.

- Estimated Tax Payments: If you prefer, you can make estimated tax payments throughout the year to cover the tax liability from the conversion.

Avoiding Underpayment Penalties

Underpaying taxes can lead to penalties from the IRS. To avoid this, you must meet certain “safe harbor” requirements:

- Pay at least 90% of what you owe for the current year.

- Alternatively, pay 100% (or 110% if your income exceeds $150,000) of your total taxes from the previous year.

Working with Professionals

Roth conversions can be complex, especially regarding tax implications and timing. It is often beneficial to consult with a financial advisor or tax professional, especially if you’re new to this process. They can help you navigate the intricacies and ensure you’re making informed decisions.

Frequently Asked Questions

What is a Roth IRA conversion?

A Roth IRA conversion is the process of transferring funds from a traditional IRA or 401(k) into a Roth IRA, which is subject to taxes at the time of conversion.

When should I consider a Roth IRA conversion?

Consider a Roth IRA conversion when you anticipate being in a higher tax bracket later, or when you want to take advantage of tax-free growth in retirement.

Can I undo a Roth IRA conversion?

No, once you convert to a Roth IRA, the transaction cannot be undone. It’s essential to carefully consider your decision before proceeding.

What are the tax implications of a Roth IRA conversion?

Converting to a Roth IRA creates a taxable event, meaning you’ll owe taxes on the amount converted in the year of the conversion.

How can I minimize taxes on my conversion?

To minimize taxes, consider converting in a year when your income is lower or spreading conversions out over several years to avoid jumping into a higher tax bracket.

Conclusion

Determining the best time of year for a Roth IRA conversion involves understanding your financial situation, market conditions, and tax implications. By employing strategic planning—whether through taking a stand on market predictions or hedging your bets with systematic conversions—you can optimize your Roth IRA conversions for maximum benefit. Seek professional guidance to navigate the complexities and make informed decisions that align with your long-term financial goals.