Resources

Resources for a smooth retirement

We’ve been helping people through retirement for almost 30 years now. We’ve created these resources to help your retirement be as smooth as it can be.

VIDEO RESOURCES

Learn how to maximize your savings and minimize your taxes in retirement

HELPFUL ARTICLES

Timely articles with timeless advice on tax savings

8 Tax-Saving Tips for Estate Planning and Roth Conversions

Craig Wear | February 28, 2025Roth conversions often don’t come to mind when discussing estate planning, but they can be a powerful tool for enhancing your financial legacy. Here, I’m […]

6 Critical Insights on Roth Conversions and RMDs

Craig Wear | February 28, 2025When it comes to managing your retirement income, understanding the relationship between Required Minimum Distributions (RMDs) and Roth conversions is crucial. This blog will explore […]

3 Valuable Tips to Optimize Your Roth Conversion

Craig Wear | February 21, 2025If you’re an IRA millionaire considering Roth conversions, it’s essential to have a well-thought-out investment transition plan. The right strategy can significantly impact your tax-free […]

THE WHAT’S NEXT PODCAST

Deep-dives into tax-saving strategies for your retirement

The Roth Illusion: Why Most Software Gets It Wrong

Hosted by: Craig WearGuest: Daniel Jandro, CFP®, Rothologist at Q3 Advisors…

Maximizing Your Medicare: Essential Tips for Open Enrollment 2024 with Expert Emily Gang

Summary: In this episode of What's Next in Retirement, Craig Wear welcomes M…

The Truth About Capital Gains and Roth Conversions – A CPA’s Take

SummaryIn this conversation, Craig Wear and Glenn Block discuss essential financial str…

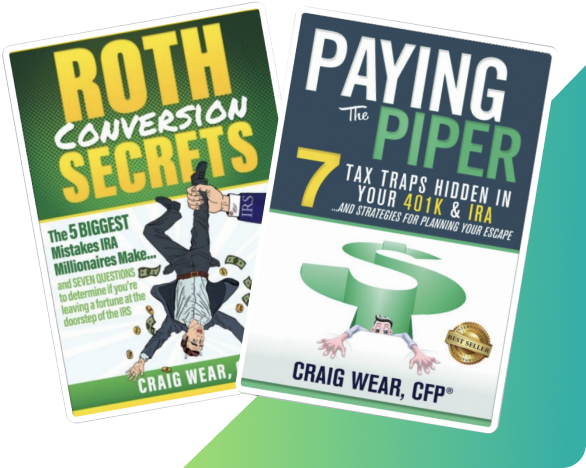

Expert Guides

These best-selling books pinpoint the traps and mistakes most people make, and get you on the right track to more money and fewer taxes in your retirement.

JOIN OUR FREE WEBINAR

The Biggest Roth

Conversion Mistake

The common Roth conversion mistake leaving hundreds of thousands of dollars (or more!) on the doorstep of the IRS

The four limiting beliefs keeping you from saving more

Traditional Roth conversion vs Optimal Rothology® Conversion – the difference can mean $1mm+ in unnecessary taxes