Roth conversions can be confusing, especially for those new to the concept. It involves changing pre-tax retirement accounts like IRAs or 401(k)s into Roth IRAs by paying taxes upfront. This process allows for tax-free growth afterward and provides flexibility in withdrawals, which is appealing to many individuals planning for their future.

Understanding who might benefit from a Roth conversion is crucial. Those with large IRAs, retirees worried about leaving taxes for their heirs, or individuals nearing retirement may find it particularly beneficial.

This article aims to clear up common queries about Roth conversions, making it easier for readers to decide if this strategy is right for them.

Key Takeaways

- Roth conversions turn pre-tax accounts into tax-free growth options.

- Paying taxes upfront can save money in the long run.

- Ideal candidates include those with large IRAs or retirement planning concerns.

What is a Roth Conversion

Roth conversions involve transferring money from pre-tax retirement accounts, like IRAs or 401(k)s, into a Roth IRA. This means paying taxes on that money now instead of later when it might be taxed at a higher rate.

Once the funds are in the Roth IRA, they grow tax-free for the account holder’s lifetime.

Key Benefits:

- No Taxes on Growth: Any money earned in the Roth IRA is not taxed.

- No Required Minimum Distributions (RMDs): Unlike traditional IRAs, there are no mandatory withdrawals from a Roth during the account holder’s lifetime.

- Tax-Free Inheritance: Heirs won’t pay taxes on money passed down from the Roth IRA.

The process to convert is straightforward. An individual can simply contact their financial institution, like Vanguard or Fidelity, and request the conversion. They must ensure they have a Roth IRA set up first.

If they plan to pay taxes from an external account, they can specify how they want to move their funds.

It’s essential to know that this conversion triggers a taxable event. However, it can lead to significant tax savings later.

The decision to do a conversion may feel daunting since it creates immediate tax liability. Still, it can be a wise choice to prevent larger tax burdens down the road.

Steps to Convert to a Roth IRA

Roth conversions involve moving money from a traditional retirement account to a Roth IRA. This means paying taxes on that money now instead of later. The main goal is to avoid higher taxes in the future.

To start the process, call the financial institution that holds the traditional IRA, such as Vanguard, Fidelity, or Schwab. They will ask for specific details:

- Open a Roth IRA: This account must be in the same name and have the same Social Security number as the traditional IRA.

- Select the Amount: Decide how much money to convert.

If taxes will be paid from outside the account, tell the custodian to transfer shares or a specific amount. If deciding to cover taxes from within the IRA, cash or shares must be sold first to have enough funds.

Key Points

- Immediate Tax Payment: The funds moved to the Roth IRA are taxable. This is an important step, as it affects the current year’s taxes.

- No Future Taxes on Growth: Once the money is in the Roth IRA, it can grow without being taxed again.

- No Required Minimum Distributions: Unlike traditional IRAs, Roth IRAs do not require minimum distributions during the account owner’s lifetime.

- Tax-Free Inheritance: Heirs do not pay taxes on the amounts they inherit from a Roth IRA.

Roth conversions can be wise, especially for those with larger traditional IRAs. It may also benefit anyone close to retirement who wants to reduce the tax burden on their heirs. Lower tax rates today create a good opportunity for future savings.

Tax Implications and Strategy

Roth conversions allow individuals to move money from traditional retirement accounts, like an IRA or 401(k), to a Roth IRA. This process involves paying taxes upfront on the money converted.

After completing a conversion, the funds in the Roth IRA grow without additional taxes for the account holder’s lifetime.

The key benefits of this strategy include:

- No Required Minimum Distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not have RMDs. This means account holders can withdraw funds when they choose without being forced to take out a certain amount each year.

- Tax-Free Withdrawals for Heirs: When the account holder passes, heirs can inherit the Roth funds without owing taxes on them. This feature can be significant for estate planning.

Considerations

- Tax Consequences: Conversion is a taxable event. Individuals should be prepared for the tax implications when deciding to convert. Planning ahead can help manage these consequences effectively.

- Timing: It’s essential to consider the timing of conversions. With current tax rates being low, many see this as an opportunity to convert and realize lower tax costs now, which may not be available in the future.

- Large Accounts: Those with substantial funds in their traditional accounts should evaluate whether conversions could save them money in taxes over their lifetime. For example, individuals with accounts holding $700,000 or more may find significant tax savings through conversions.

- Retirement Planning: If nearing retirement, it can be wise to incorporate Roth conversions into financial strategies. This method can help avoid large tax burdens on distributions during retirement years.

See also: 3 Common Roth Conversion Mistakes

Recommendations

- Assess Current Income and Future Tax Rates: Before converting, individuals should assess their current income, potential tax changes, and future financial needs.

- Use Cash Flow Wisely: Instead of increasing 401(k) contributions, consider allocating that same cash flow to conversions. This approach can yield better tax outcomes long-term.

- Consider Cohorts: Mid-70s individuals or those concerned about leaving large tax burdens to their heirs are typically good candidates for Roth conversions.

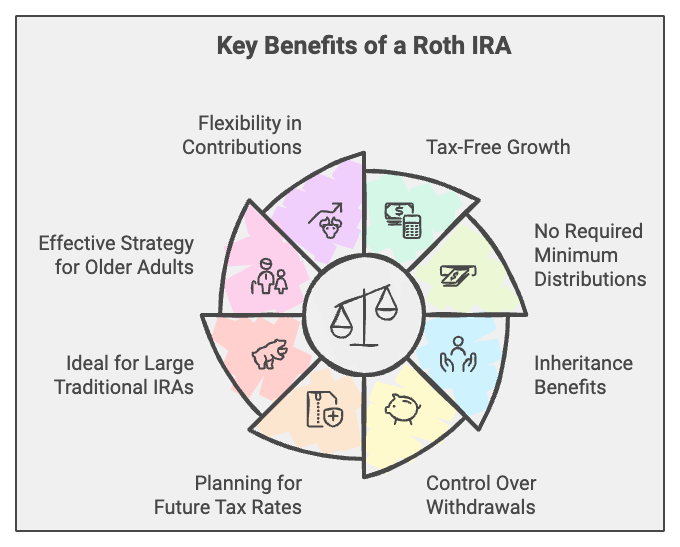

Advantages of a Roth IRA

A Roth IRA offers several benefits that can be key for financial planning.

- Tax-Free Growth: Once funds are in a Roth IRA, any growth is not taxed. This means that any earnings from investments in the account remain untaxed for the rest of the account holder’s life.

- No Required Minimum Distributions (RMDs): Unlike traditional IRAs, a Roth IRA does not require account holders to take minimum distributions at a certain age. This allows for more flexibility in managing finances.

- Inheritance Benefits: When account holders pass on their Roth IRA to heirs, those beneficiaries can receive the funds tax-free. This can significantly reduce the tax burden on the next generation.

- Control Over Withdrawals: Funds can be withdrawn tax-free, which can be useful for large expenses or emergencies. For instance, if someone needs $20,000 for a family vacation, they can take it out without worrying about additional taxes.

- Planning for Future Tax Rates: Current tax rates are among the lowest seen in decades. By converting funds to a Roth IRA now, individuals may shield themselves from higher taxes in the future.

- Ideal for Large Traditional IRAs: For individuals with substantial traditional IRAs, such as those exceeding $700,000, Roth conversions can help reduce future tax liabilities and protect assets from hefty tax bills upon withdrawal.

- Effective Strategy for Older Adults: Those nearing retirement or in their seventies can benefit from converting to a Roth IRA to prevent leaving a significant tax burden to their heirs.

- Flexibility in Contributions: Rather than focusing solely on contributions to a 401(k), individuals might find it more beneficial to use cash flow for Roth conversions, which can multiply the benefits of their retirement strategy.

Choosing the Optimal Moment for a Roth Conversion

Roth conversions can be a valuable strategy for many people looking to manage their retirement funds. This process involves taking money from accounts like an IRA or 401(k), paying taxes on it now, and moving it into a Roth IRA.

The biggest advantage is that once the money is in the Roth IRA, it grows tax-free for life, and there are no required minimum distributions.

A few key benefits of converting include:

- Tax-Free Growth: After converting, all future growth in the account is tax-free.

- No Required Minimum Distributions: Unlike traditional IRAs, Roth IRAs do not require distributions at any age.

- Tax-Free Transfers to Heirs: Heirs can inherit the Roth IRA without owing taxes on it.

When considering a conversion, timing can be essential.

For individuals with large retirement accounts, such as those worth $700,000 or more, making the switch may prevent future tax liabilities that could amount to a significant loss.

With tax rates at historic lows, now can be an excellent time to pay taxes on those accounts, potentially saving money in the long run.

Candidates who may benefit most from a conversion include:

- Individuals aged 70 and older, who wish to lessen the tax burden on their heirs.

- Those in their last working years, who are currently contributing heavily to their 401(k), as converting early could be more advantageous than adding to their taxable income.

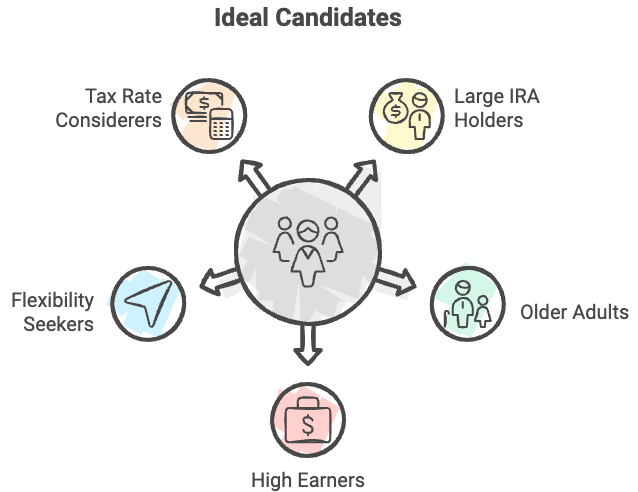

Suitable Candidates for Roth Conversion

Roth conversions can be beneficial for various individuals depending on their financial situations. Here are some of the ideal candidates for this strategy:

- Individuals with Large IRAs: Those with substantial retirement accounts, like IRAs valued at $700,000 or more, may want to consider converting some or all of that money. This could help reduce future tax obligations.

- Older Adults Concerned About Heirs: People in their mid-70s or older who wish to avoid burdening their heirs with taxes may also be good candidates. Converting can simplify the financial legacy they leave behind.

- High Earners in the Last Working Years: Those nearing retirement who are making significant contributions to their 401(k) should evaluate their options. They might benefit more from converting pre-tax funds into a Roth IRA instead of increasing their existing tax-deferred accounts.

- Individuals Seeking Flexibility in Retirement: Converting to a Roth IRA allows for tax-free withdrawals in retirement. This can provide financial freedom for purchasing large items or taking vacations without worrying about tax implications.

- Tax Rate Considerations: As current tax rates are relatively low, individuals who anticipate higher future taxes should act now. Paying taxes on converted amounts could lead to long-term savings.

Differences Between Roth IRA and Traditional Retirement Accounts

Roth conversions allow a person to move money from a traditional retirement account into a Roth IRA. This means they pay taxes on the amount converted now, but they can avoid higher taxes later when they withdraw that money.

This process involves transferring pre-tax funds from accounts like an IRA or 401(k) into a Roth IRA.

How to Convert

To convert funds, an individual simply contacts their financial institution, like Vanguard or Fidelity, and initiates the transfer.

It’s necessary to have a Roth IRA account set up beforehand. They can decide how to cover the tax for the amount being converted, either from the account or another source.

Important Considerations

- Initial Tax Impact: Converting funds creates a taxable event. The individual needs to prepare for this tax payment, as it can affect their current income tax situation.

- Long-Term Planning: Doing a Roth conversion can help avoid larger tax bills later on, especially if the account grows significantly. It’s important to consider future tax rates and personal circumstances when deciding to convert.

- Ideal Candidates: Those with large amounts in traditional accounts, older individuals concerned about tax burdens on heirs, and people nearing retirement can all benefit from considering Roth conversions.

Ways to Reduce Tax Burden

Roth conversions allow individuals to move money from pre-tax accounts like IRAs and 401(k)s into a Roth IRA. In this process, taxes are paid upfront, which can lead to tax savings in the future. Here are some key points about this strategy:

- Tax-Free Growth: Once the money is in a Roth IRA, all future growth is tax-free. This means no taxes on the earnings while the funds grow.

- No Mandatory Withdrawals: Roth IRAs do not require minimum distributions during the account holder’s lifetime. This feature gives more control over how and when to withdraw funds.

- Beneficial for Heirs: If the account holder passes away, their heirs can inherit the Roth IRA without owing taxes on the amount they receive.

The Conversion Process

- Initiate the Conversion: To convert funds, the individual must contact their account custodian (like Vanguard or Fidelity) and request the transfer to a Roth IRA.

- Paying Taxes: Individuals can pay the conversion taxes from an external account or within their IRA, using liquidated assets.

- Tax Consequences: The conversion is a taxable event, but it may help avoid higher taxes in the future.